car sales tax wake county nc

The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina state sales tax and 250 Wake County local sales taxesThe local sales tax consists of a 200 county sales tax and a 050 special district sales tax used to fund transportation districts local attractions etc. North Carolina collects a 3 state sales tax rate on the purchase of all vehicles.

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Do North Carolina vehicle taxes apply to trade-ins and rebates.

. Wake County sales tax. This sales tax is known as the Highway Use Tax and it funds the improvement and maintenance of. The latest sales tax rate for Cary NC.

You can find these fees further down on the page. Average Sales Tax With Local. This rate includes any state county city and local sales taxes.

Find important information on the departments listing and appraisal methods tax relief and deferment programs exempt property. 2020 rates included for use while preparing your income tax deduction. County rate 60 Raleigh rate 3730 Combined Rate 9730 Recycling Fee 20.

This table shows the total sales tax rates for all cities and towns in. Find Wake County Tax Records. Data Files Statistics Reports Download property data and tax bill files.

Use the Wake County Tax Portal to view property details research comparable sales and to file a real estate appeal online. The type of vehicle determines the amount of tax paid as detailed in the following table. The department also collects gross receipts taxes.

35 rows Sales and Use Tax Rates Effective October 1 2020. Even so until eventually 1986 the corporation achieved one of its primary targets. Breaking into the American market.

The North Carolina state sales tax rate is currently. The 2018 United States Supreme Court decision in South Dakota v. Johnston Street Smithfield NC 27577 Collections Mailing Address.

The December 2020 total local. North Carolina has a 475 sales tax and Wake County collects an additional 2 so the minimum sales tax rate in Wake County is 675 not including any city or special district taxes. Please enter the following information to view an estimated property tax.

Plus 20 Recycling fee 196600 estimated annual tax. North Carolina Sales Tax. 2000 x 9730 194600.

Johnston street smithfield nc 27577 collections mailing address. Nc Sales Tax Wake County Nc Sales Tax Wake County - Throughout the 1980s Hyundai saw rapid advancement producing substantial inroads into global markets. Box 451 Smithfield NC 27577 Administration Mailing Address.

This is the total of state and county sales tax rates. These records can include Wake County property tax assessments and assessment challenges appraisals and income taxes. Revenue from the highway-use tax goes to the North Carolina Highway Trust Fund and the North Carolinas General Fund and is earmarked for road improvements.

The calculator should not be used to determine your actual tax bill. Wake County NC Sales Tax Rate. The current total local sales tax rate in Wake County NC is 7250.

There are a total of 459 local tax jurisdictions. North Carolina assesses a 3 percent sales tax on all vehicle purchases according to CarsDirect. To review the rules in North Carolina visit our state-by-state guide.

Some vehicles are exempt from the highway-use tax. Listed below by county are the total 475 State rate plus applicable local rates sales and use tax rates in effect. Has impacted many state nexus laws and sales tax collection requirements.

The 725 sales tax rate in cary consists of 475 north carolina state sales tax 2 wake county sales tax and 05 special tax. A motor vehicle with a value of 8500. Your county vehicle property tax due may be higher or lower depending on other factors.

In addition to taxes car purchases in North Carolina may be subject to other fees like registration title and plate fees. The Wake County Sales Tax is collected by the merchant on all qualifying. Box 368 Smithfield NC 27577.

Property value divided by 100. Includes the 050 transit county sales and use tax. North Carolina state sales tax.

This calculator is designed to estimate the county vehicle property tax for your vehicle. North Carolina has state sales tax of 475 and allows local governments to collect a local option sales tax of up to 275. The Wake County Department of Tax Administration appraises real estate and personal property within the county as well as generating and collecting the tax bills.

Johnston County Tax Administration Office. The total sales tax rate in any given location can be broken down into state county city and special district rates. Wake County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Wake County North Carolina.

Although the process of assessing annual vehicle property taxes may seem somewhat complex the nc vehicle sales tax is relatively straightforward. The Wake County sales tax rate is. The property is not located in a municipality but is in a Fire District.

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Used Cars Trucks And Suvs For Sale Wake Forest Nc Raleigh Durham

Wake County North Carolina Nc Jobs Wake Employment Opportunities Directory

Wake County Nc Property Tax Calculator Smartasset

2 Million Dollar Housesd Million Dollar Homes Multi Million Dollar Homes Dream House

Group Vehicle Inventory Apex Nc Group Dealer In Wake Forest Nc New And Used Group Dealership Prince George Va Indian Trail Nc Wake Forest Nc Nc

3312 Donlin Dr Wake Forest Nc 3 Baths Wake Forest Home Bedroom Flooring

Wake County Restocking Free N95 Masks On Tuesday Wral Com

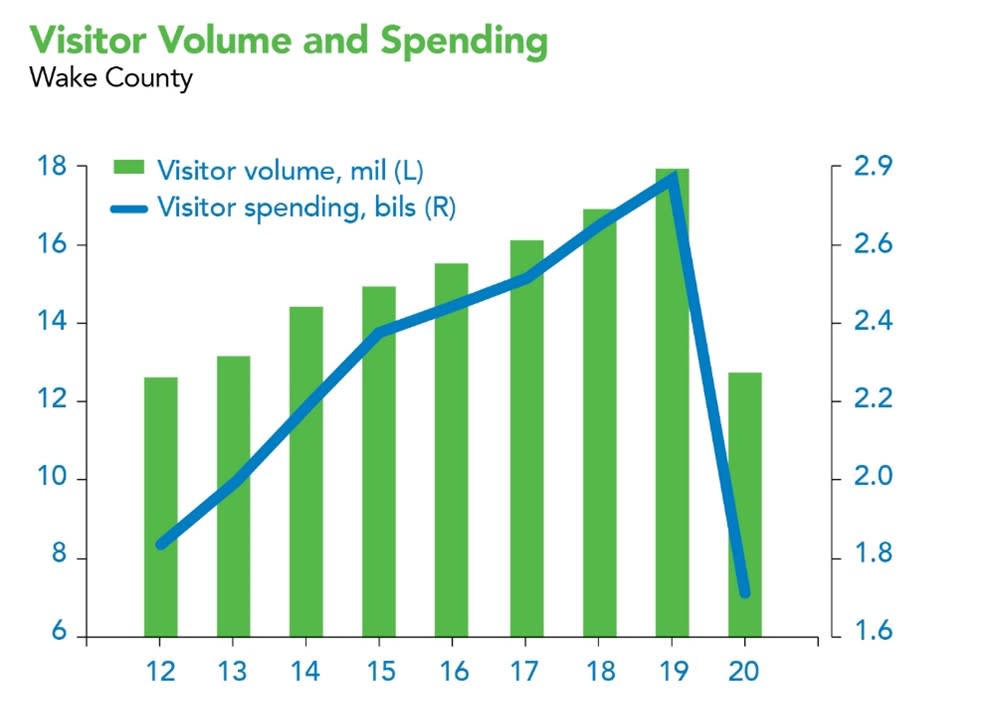

2020 Wake County Visitation Figures Released

Nissan Service Specials Wake Forest Nc Nissan Parts Specials Crossroads Nissan Wake Forest

North Carolina Nc Car Sales Tax Everything You Need To Know

New Hyundai Cars And Suvs For Sale Wake Forest Nc Raleigh

North Carolina Sales Tax Small Business Guide Truic

North Carolina Sales And Use Tax Audit Guide

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

2011 Carolina Skiff 238 Dlv For Sale Fishing Boats For Sale Center Console Fishing Boats Center Console Boats

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More